A New Way to Ensure the Clarkson Experience

In 2020, Clarkson University launched a private label donor advised fund in partnership with the BNY Mellon Charitable Gift Fund. The Clarkson University Donor Advised Fund (DAF) is a philanthropic vehicle that allows donors to make a charitable contribution, receive an immediate tax benefit, and then recommend grants from the fund over time. Donors can contribute to the fund as frequently as they like, and in doing so they retain the right to advise when and to which charities grants from their fund will be made.

Creating a DAF with Clarkson University is an easy and effective way to support our students, our programs and our faculty. Creation of a private label donor advised fund at Clarkson University also makes you a member of the Annie Clarkson Society, where you will join others who, through their philanthropy, have enhanced their lifelong relationship with Clarkson. If you already have a donor advised fund, and are interested, you can transfer assets from your current DAF to ours.

Learn more about the Clarkson University Donor Advised Fund by visiting our Clarkson University Donor Advised Fund website or view the information sheet below.

What are the benefits of the Clarkson University Donor Advised Fund (DAF)?

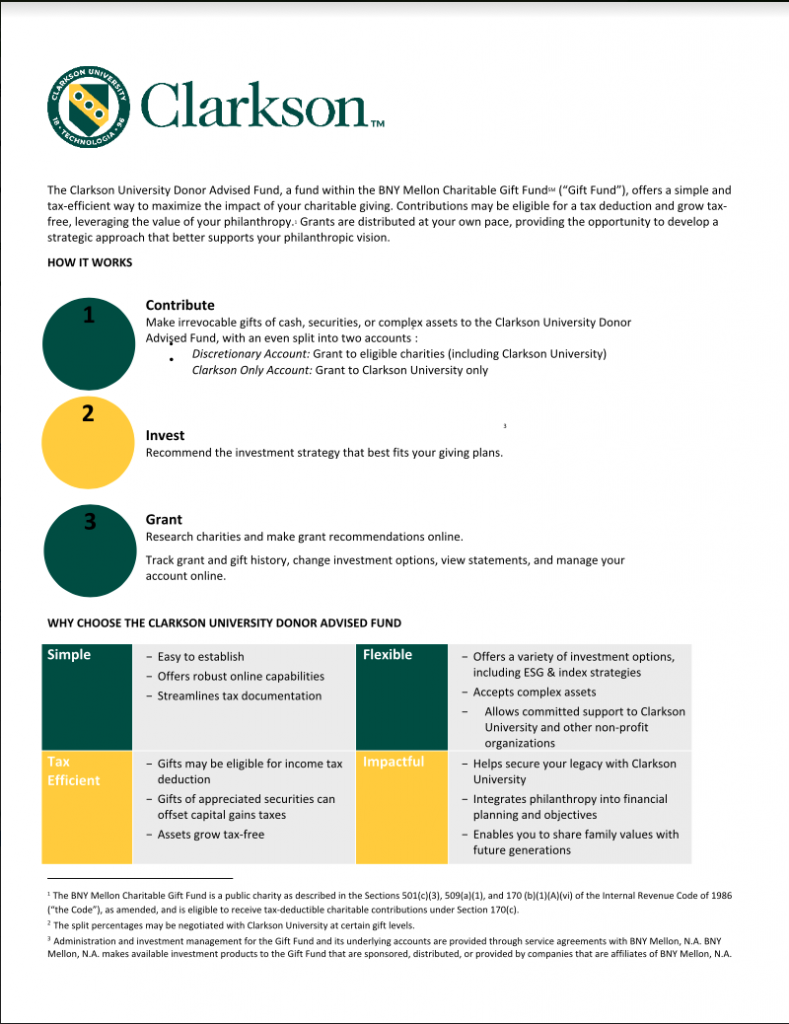

- You receive an immediate tax deduction while assets grow tax-free, allowing you to give at your own pace.

- It accepts cash, securities (including mutual funds), and complex assets like private equity funds, partnership interests, privately held shares, and art.

- You can give to multiple charities with ease and from the same account.

- It is a tax-efficient and cost efficient alternative to setting up a private foundation.

- Our Donor Advised Fund is a great way to engage your family in philanthropy.

How the Clarkson University Donor Advised Fund (DAF) works:

For more information about creating a DAF with Clarkson or rolling over an existing one, contact Steven Smalling, Associate Vice President of Development, at 315-244-7945 or email him at steven.smalling@clarkson.edu.

Donor Advised Fund Grants to Clarkson University from other DAFs

The University is also still eligible to receive grants from other Funds. Information you may need to request a grant to Clarkson:

Clarkson University

8 Clarkson Ave, Box 5522

Potsdam, NY 13699

Contact: Annie Clarkson Society, anniesociety@clarkson.edu or call 315-268-7778

Federal ID Number: 15-0543659

Clarkson has 501(c)(3) charity status

Grants from donor-advised funds are not always clearly identified when Clarkson receives them. It is useful for a donor to advise Clarkson using the contact information above when a grant request is made.

Grants may be made for annual, unrestricted gifts to the Clarkson Fund.

Grants may be restricted to other purposes at the University.

Grants may be made to endowments at the University.

As an estate gift, Clarkson may be named as the final beneficiary of a DAF when it terminates.

You can contact the Annie Clarkson Society for more information.

Follow us on Twitter @annieclarkson

This web page does not provide legal or financial advice, nor is it a comprehensive review of the topic. You should consult your legal and financial advisors and Clarkson University before making or planning your gift.iu dxU